Charitable Lead Annuity Trust

This trust allows you to receive up front tax deductions for future charitable gifts.

- Select a time period (typically 10 years, 20 years, or lifetime)

- Move non-qualified money into this trust (in-kind transfer)

- This asset will be continued to be managed by you as trustee

- The trust gives charity a percentage of the initial value each year (typically 5%)

- Receive a present value charitable deduction for the future gifts

- At the end of the trust period, the assets will come back into your non-qualified account or can be used for estate planning purposes and given to an irrevocable family trust

Short 1 minute video

Longer, 2 minute video with more details

In The News

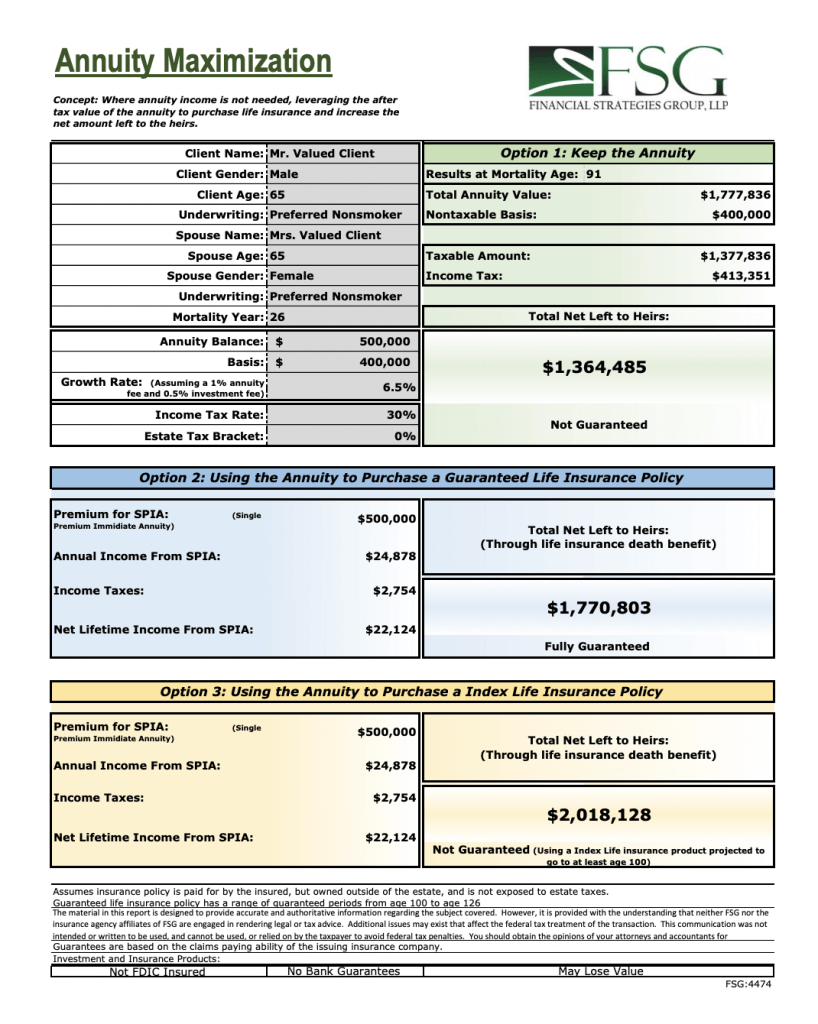

How to Leverage Old Annuities to Provide More for Your Heirs

August 2020

FSG, offers opportunities to leverage previously purchased annuities to give greater, fully guaranteed funds to heirs.