IRA Max

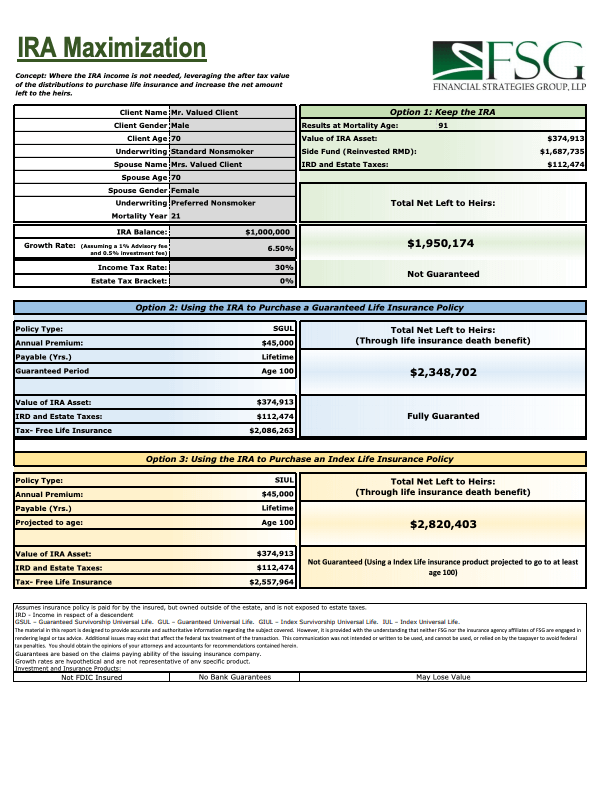

Why a client might want to consider this:

IRA planning has changed due the Secure Act Law so we are looking at options to maximize that asset. We don’t see you needing your IRA for retirement and it’s one of the last things we would want to draw from due to the money coming out all taxable. Let’s set up a call or meeting to lay out the options so we can pay the least amount of taxes and leave the most to the kids.